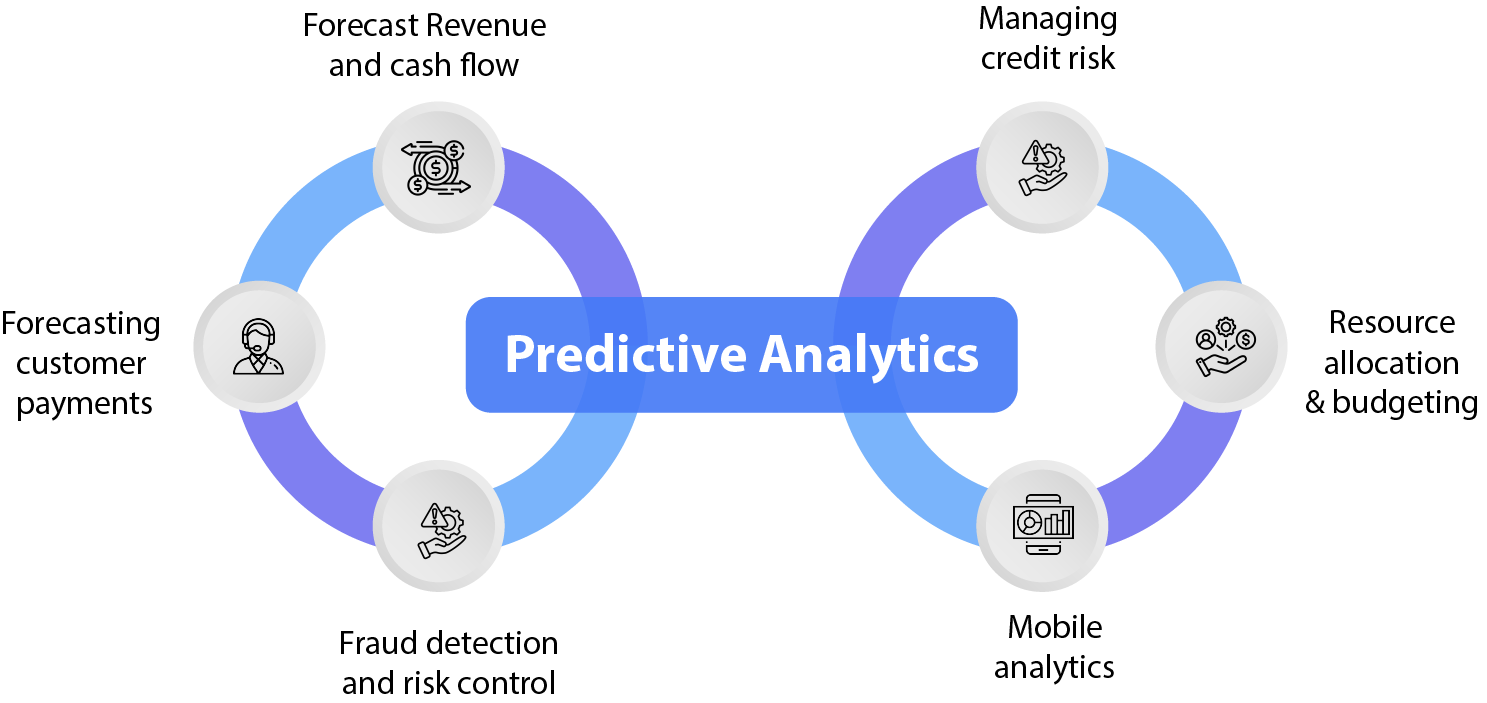

Forecast Revenue and cash flow

Cash flow forecasting models based on predictive analytics help finance teams gain a better understanding of their revenue and production by analyzing invoice data, past payment trends, cash position, and other factors.

By forecasting cash flows and the timing of cash flows, with Qi platform financial professionals can better plan their investments, segment customers based on the likelihood of payments, and optimize cash flow.

Forecasting customer payments

Predictive analytics algorithms can help financial professionals predict whether customers will pay on time, whether customers will make partial or short payments, or whether customers will demand payment after the due date.

By analyzing factors such as past payment trends, financial strength and market conditions, predictive analytics models can help collectors prioritize accounts and tailor customer interactions based on their likelihood of payment. This can help finance teams avoid spending too much time and effort on customers who are likely to pay less.

Fraud detection and risk control

When a company spends money on things like technology, investments and credit sales, there is risk involved. It is important to minimize these risks so that the company does not suddenly lose money. Forecasting techniques are like super detectives for businesses. They notice small changes in the use of money and help predict and detect fraud.

Using these techniques Qi Platform can predict and identify risks associated with various tasks and show which ones can really hurt the business.

Managing credit risk

Proactive analysis in finance improves credit risk by evaluating the customer’s creditworthiness during credit transactions. Using a variety of data sources, including credit reports and market data, it provides a comprehensive scoring system. An AI-driven engine anticipates potential issues, such as blocked orders, based on the customer’s payment history and credit limit usage, which prompts effective risk management strategies.

In this context, our Qi platform helps assess customers and recognize the status of risk each time a credit sale is created. It utilizes diverse data sources such as credit reports and market data to minimize payment risks. The AI models also enable predict blocked orders based on the customer’s payment history and credit limit usage.

Resource allocation and budgeting

Finance teams can find patterns and trends in data from many sources and determine whether budget allocations are likely to yield the intended return on investment by using predictive analytics technologies.

By analyzing historical data, predictive analytics can suggest the best possible ways to allocate resources and avoid overspending or underspending.

Mobile analytics

Mobile analytics can be a convenient tool for CFOs who are often behind their desks. With Qi platform, CFOs can efficiently track key numbers like bad debt write-offs and distribution network operators and work with working capital anywhere.

Using predictive analytics, financial professionals can better understand their data, reduce risk, and simplify their work in many different areas.

Predictive analytics plays a key role and delivers many benefits that allow financial institutions to make more intelligent decisions and navigate a tough environment more efficiently. With predictive analytics, financial experts can achieve revenue growth by leveraging data-driven insights into profitable investment strategies. Furthermore, predictive analytics helps lower risk by facilitating evidence-based decision-making and improving overall risk management practices.

Also, the application of predictive analytics significantly contributes to fraud prevention, as it accurately detects fraudulent actions in real-time, thus ensuring financial integrity. In addition, integrating predictive analytics into financial operations lowers costs, increases employee satisfaction, improves decision-making, improves customer retention strategies, and the ability to quickly adapt to market changes.

Embracing predictive analytics guarantees a better rewarding financial environment for everyone involved in finance raising efficiency and security.

How Qritrim’s AI and ML Capabilities Transform Predictive Analytics in Financial Services

The Qi platform leads way in financial technology innovation by presenting transformative predictive analytics solutions. With its seamless integration of cutting-edge AI and machine learning capabilities, Qi plays a vital role in empowering financial services. It revolutionizes how the industry makes data-driven decisions and enhances operational efficiency.

Qi’s advanced customizable, reusable AI models and pipelines specifically address the nuanced needs of the financial industry. Using Qi’s creative artificial intelligence and domain-specific ontologies, financial institutions can achieve unparalleled predictive analytics. This means better risk analysis and fraud detection, enabling financial professionals to predict payment behavior, prioritize accounts and adjust customer engagements.

In addition, the Qi platform can revolutionize resource allocation and budgeting through predictive analytics and provides valuable insights from historical data to optimize resource allocation and reduce financial risk.

The seamless integration and scalable qualities of the Qi platform guarantees that financial organizations can effectively utilize predictive analytics to enhance informed decision-making and operations, eventually transforming the financial services landscape.